Press Release: Zion Oil & Gas Announces Subscription Rights Offering

Zion Oil & Gas Announces Subscription Rights Offering

Rights offering to prepare Zion Oil & Gas for future exploration and production in Israel

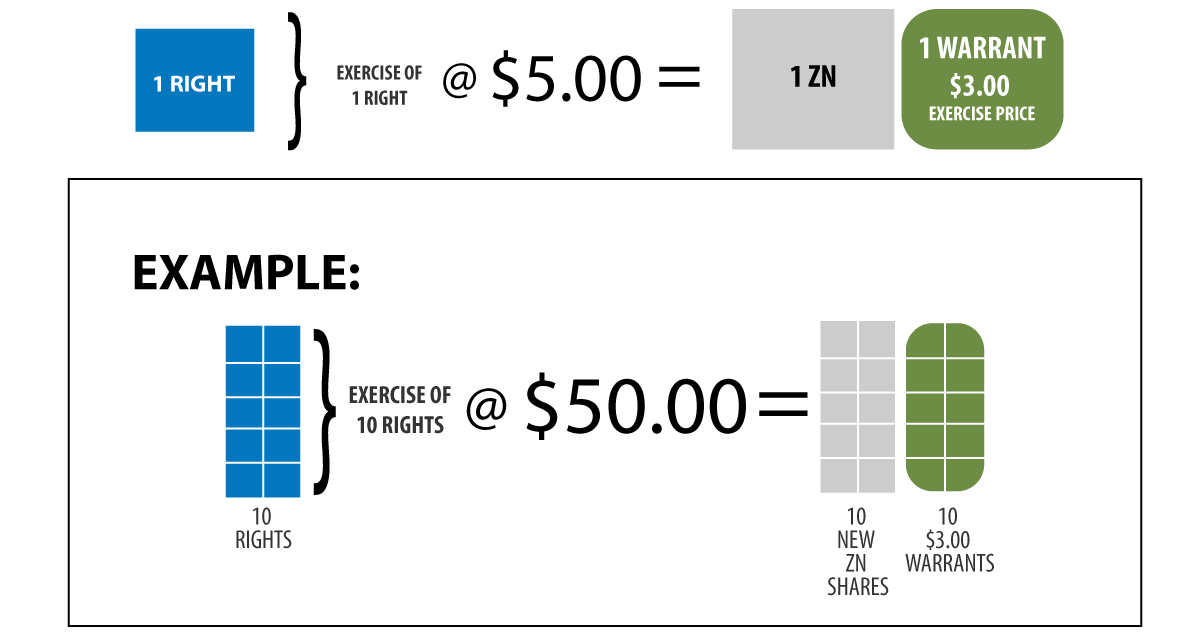

DALLAS and CAESAREA, Israel, April 3, 2018 – Zion Oil & Gas, Inc. (NASDAQ: ZN) today announced it will be offering rights (the “Rights Offering”) to holders of its common stock of record at the close of business on April 13, 2018. Pursuant to the Rights Offering, each holder of shares of common stock on the record date of April 13, 2018 will receive non-transferable rights to subscribe for Rights, with each Right comprised of one (1) share of our Common Stock, par value $0.01 per share (the “Common Stock”) and one (1) Common Stock Purchase Warrant to purchase an additional one (1) share of Common Stock. Each Right may be purchased at a per Right subscription price of $5.00. Each Warrant affords the investor the opportunity to purchase one share of our Common Stock at a warrant exercise price of $3.00. The warrants will become exercisable on June 29, 2018 and will continue to be exercisable for one (1) year thereafter. The warrants are not tradeable.

The Company filed an amendment to the prospectus supplement dated April 2, 2018 to reflect the new record date of April 13, 2018. Accordingly, all references to the “Record Date” or similar term in the original prospectus supplement indicating a Record Date of March 12, 2018 should be replaced with the new Record Date of April 13, 2018. The Rights Offering is scheduled to expire on May 31, 2018.

The Rights Offering is being made pursuant to Zion’s effective shelf registration statement on Form S-3 (File Registration Number 333-216191) on file with the Securities and Exchange Commission (“SEC”) and the related prospectus supplement filed with the SEC on April 2, 2018, as amended by Amendment No. 1 thereto filed on April 3, 2018.

This communication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities, and there will be no sale of any securities in any state in which such an offer, solicitation, or purchase would be unlawful prior to the registration or qualification of such securities under the securities laws of any such state.

Click Here To Understand More About Our 2018 Rights Offering >>

NOTICE: Zion Oil & Gas, Inc. has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should carefully read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about Zion Oil & Gas and its offering. The Subscription Rights Offering is made only by means of the Prospectus Supplement dated April 2, 2018 of the Prospectus dated March 7, 2017, as subsequently amended, filed with the SEC, and related documents. A copy of the prospectus may be obtained, free of charge, on the SEC website at www.sec.gov, or by contacting us at rightsoffering@zionoil.com or by calling at 888-891-9466.

Contact:

Zion Oil & Gas, Inc.

12655 North Central Expressway, Suite 1000

Dallas, TX 75243

Andrew Summey

Telephone: 214-221-4610

Email: rightsoffering@zionoil.com

www.zionoil.com

Would like to learn more about Rights Offerings. Is the actual physical address for Zion Oil & Gas located at 12655 North Central Expressway, Suite 1000, Dallas, TX 75243. We are planning a trip to the Dallas/Fort Worth area to visit family and would like to come by for a personal meeting with a representative of Zion Oil & Gas to discuss the actual benefits of participating.

Best regards,

Silas “Buddy” Wright

Feel free to reach out to set up a day/time. Email info@zionoil.com